38+ qualifications for a reverse mortgage

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. To qualify for a reverse mortgage the borrower must have at least 50 equity in the home.

Most Reverse Mortgages Terminated Within 6 Years According To Hud

As part of the reverse mortgage application process the lender will likely conduct a title search on the house to determine if there are any existing federal.

. Ad Use Our Comparison Site Find Out Which Lender Suits You Best. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web Reverse mortgage age requirements technically depend on the type of reverse mortgage you decide to take out but dont expect to qualify if youre not near traditional retirement age.

Compare Our List Of Popular Reverse Mortgage Lending Companies Quickly and Easily. Web Learn what a reverse mortgage is A reverse mortgage is a special type of home loan only for homeowners who are 62 and older. Compare a Reverse Mortgage with Traditional Home Equity Loans.

This is true for government-sponsored home equity conversion mortgages and most private reverse. Most jumbo reverse mortgage lenders also require applicants to be 62 but a. Ad Find Out If A Reverse Mortgage Is Right For You.

Compare 10 Lenders and Learn Pros Cons. Skip The Bank Save. The purpose of counseling is to determine your eligibility and to help you learn more about how a reverse mortgage works.

Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Web PERSONAL REQUIREMENTS All borrowers on the homes title must be at least 62 years old. Read more Not everyone is eligible for a reverse mortgage Along with age there are a few other requirements for taking out a.

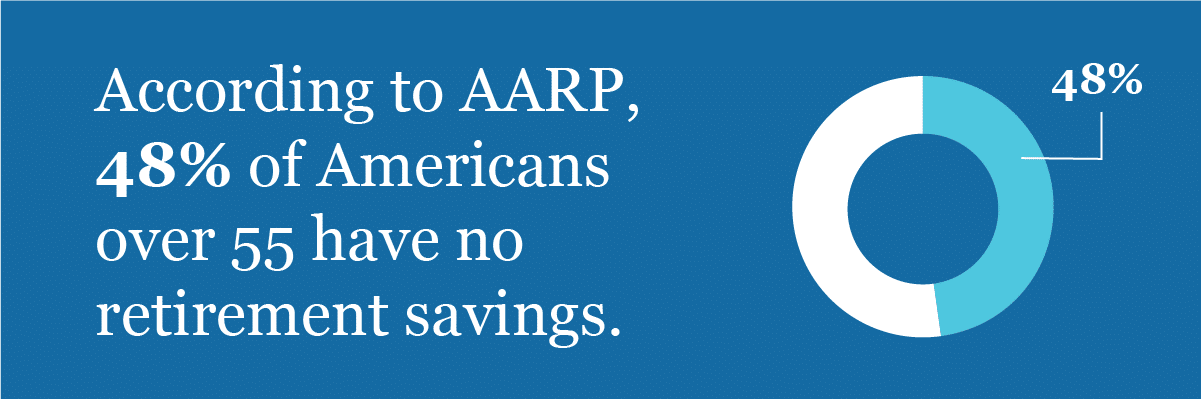

With a reverse mortgage the amount of money you can borrow is based on how much equity you have in your home. For Homeowners Age 61. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Get A Free Information Kit. Web Reverse mortgage age requirements First and foremost the homeowner must be 62 or older. When you take out a reverse mortgage you remain the homeowner responsible for paying property taxes insurance and maintenance.

Web In most cases a reverse mortgage is due when the borrower either passes moves house or sells the property. Web In the case of married couples both can be on the reverse mortgage if they are at least 62 years old and theyre listed on the property together. Web HUD improved non-borrowing spouse protections for reverse mortgages with case numbers designated on or after Aug.

To help you decide if a reverse mortgage is right for you call us toll free today at 855-523-4326 and speak with one of our reverse mortgage experts. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. It changed the law so that newly issued loan contracts would allow non.

Additionally theyll consider the following when determining how much you can take out. Vacation homes or rental properties are. Your reverse mortgage payment option.

Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Your ability to pay property taxes and homeowners insurance. Web Borrower Requirements.

Web Any homeowner age 62 or older who meets the reverse mortgage eligibility requirements listed below can apply for one. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Use the home as your primary residence.

If one homeowner is 62 but their spouse isnt and both spouses are listed on the property as owners its still possible to qualify for a reverse mortgage. With a reverse mortgage the amount the homeowner owes goes upnot downover time. For Homeowners Age 61.

Ad Compare the Best Reverse Mortgage Lenders. Title and reverse mortgages work similarly to any other mortgage. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

However the spouse whos not yet. Your equity is how much money you could get for your home if you sold it minus what you owe on your mortgage. Review 2023s Best Reverse Mortgage Lenders.

While living at the property you dont need to worry about paying back the loan. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility.

The older you are the more funds you can receive from a Home Equity Conversion Mortgage HECM reverse mortgage. Be 62 years of age or older. Web Title and Reverse Mortgages.

To qualify for a reverse mortgage you must. Web For government-insured HECMs and for state or local government-sponsored single-purpose loans the minimum age is 62. You must live in your home as your primary residence for the life of the reverse mortgage.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Complete counseling with a HUD counselor 2. Web If youre 62 or older you might qualify for a reverse mortgage.

Compare Top Lenders and Learn Pros Cons. Web For HECMs lenders will typically look for at least 50 equity in the home.

Reverse Mortgage Eligibility Requirements

Reverse Mortgage Eligibility Requirements

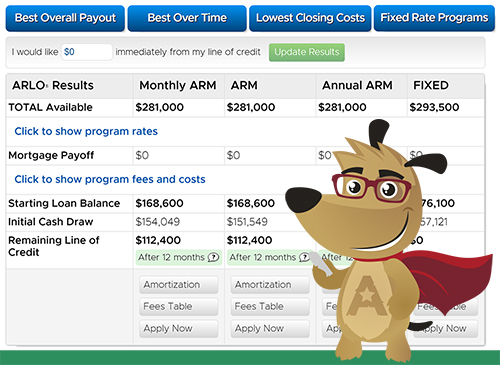

Reverse Mortgage Income Requirements Just Ask Arlo

Reverse Mortgage Age Requirement Minimum Goodlife

Zero Point Mortgage Services Mortgage Brokers You Can Trust

Reverse Mortgage Age Requirement Minimum Goodlife

How To Qualify For An Fha Reverse Mortgage Hecm

5 Best Reverse Mortgage Companies Lendedu

Eligibility Requirements For A Reverse Mortgage Rr

Reverse Mortgage Eligibility Reverse Mortgage Rules

Eligibility Requirements For Reverse Mortgage Rmf

Reverse Mortgage Age Requirement Minimum Goodlife

Pdf Not All Measures Of Income Inequality Are Equal A Comparison Between The Gini And The Zenga B Corbett Ricardas Zitikis And R Williams Academia Edu

What Is A Reverse Mortgage Reverse Mortgage Requirements

Mortgage Broker Diamond Creek Mernda Wonga Park Mortgage Choice

Family Evicted Properly From Their Home Of 38 Years Days Before Christmas Habitat For Humanity Insists R News

What Is A Reverse Mortgage